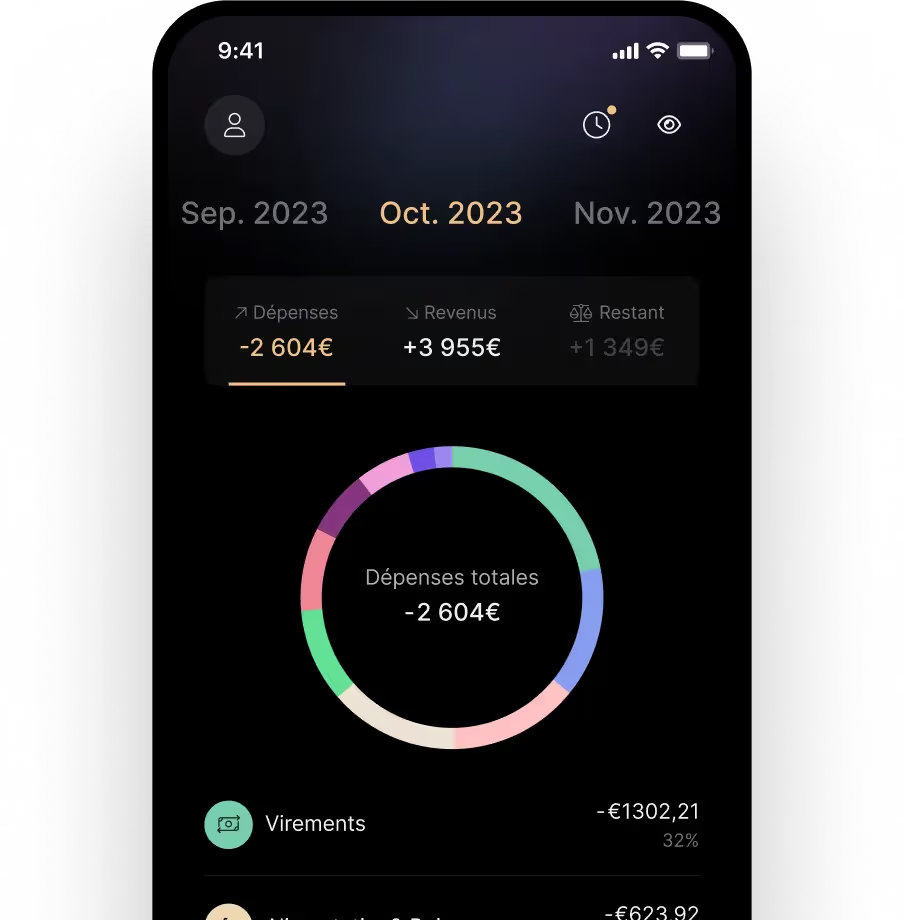

In the "Money Out" tab, you'll see a concise breakdown of your expenses. It's practical and informative, providing a clear picture of where your money is going.

Drill down into each spending category to examine individual transactions. This detailed view assists in identifying spending patterns and areas for budget adjustments, leading to smarter financial management and savings strategies.

The "Money In" tab offers a clear view of your income sources. It's straightforward, showing where your earnings come from, and helps you track and understand your income better.

By default, transactions will be categorized across these different expense categories: Auto & Transport, Subscriptions and Bills, Cash & Checks, Business & Work, Food & Drink, Investment, Health, Loan Repayment, Refunds, Taxes, Transfers, Essential Needs…

Of course, if some transactions are not relevant in the analysis of your budget, such as a transfer between two accounts (which is not a real expense), you can indeed exclude it from the analysis.

It is entirely possible to customize transaction categories using smart rules, by selecting only transactions that meet certain criteria (e.g., contains the word, greater/lesser than, etc.)

This diagram illustrates how money is allocated or spent. The larger the amount allocated to a category, the wider the associated line, allowing for a quick and clear visualization of where most of the money in the budget is going.

In our case, the left side represents the entries (all your sources of income) and on the right your outflows (investments and expenses).

We do not store your login information and do not perform transactions on your accounts. Our level of access is "read-only".

Your transactions are stored in a database so that we can assign them categories and display them to you. The only access to this database does not allow linking a transaction to a person.

A limited number of members of the technical team and support team can access it for debugging or support needs upon your request.