How to generate passive income with cryptocurrencies?

Is it possible to generate interest with your cryptos? New solutions are emerging for holders of Bitcoin, Ethereum, and others. Today we present to you Just Mining

Generating passive income through cryptocurrencies

It is now a fact that cryptocurrencies have triggered a real revolution in the investment sector. While this asset class is widely criticized for its volatility, its popularity has been constantly increasing since the arrival of Bitcoin on the market in 2009. Crypto has changed the lives of many investors by generating mind-blowing capital gains. Who says capital gains says taxes: the cryptocurrency taxation has become a real headache for many investors...

Investing in cryptocurrencies is now very popular with French people and more and more solutions are available to “crypto holders” allowing them to generate interest on the cryptocurrencies they own at rates defying conventional savings products. Today, we are analyzing the solutions offered by the French platform. Just Mining.

Interview with Owen Simonin (aka Hasheur), the founder of Just Mining

Crypto staking: generating revenue by participating in the blockchain

Staking consists in immobilizing your cryptocurrencies in a digital wallet or “wallet” in order to contribute to the operations of a blockchain. Crypto staking happens on tokens that have Proof-of-Stake (PoS) as a validation protocol.

PoS thus associates the level of trust granted to a member of the network with the number of tokens that it is ready to immobilize. Conversely, Proof-of-Work (PoW), Bitcoin's validation protocol, uses “mining”, which is a process consisting in solving complex mathematical equations using computer resources. It requires a lot of energy resources and overpowered miners.

When a member of the network immobilizes their cryptos for a certain period of time, they receive rewards in exchange that can be similar to dividends. These rewards, presented as annualized interest rates, depend on several factors: the number of blockchain participants offering staking, the asset's immobilization time, and the network offering staking itself.

You can do some Cryptocurrency staking on Just Mining ! They offer more than a dozen crypto projects including several tokens from the top 10 cryptocurrencies: Cardano, Solana or even Polkadot.

Crypto lending: earning interest on your stablecoins

Appeared with the phenomenon DeFi (decentralized finance), crypto lending is one of the star applications of the latter. It allows users who hold stablecoins (cryptocurrencies pegged to a stable value such as USD or EUR) to “lend” them to other users in exchange for remuneration in the form of interest called APR (Annual Percentage Rate) or annual percentage return.

Lending is made possible by smart contract technology where a decentralized protocol or platform connects the two parties, creating a loan service between individuals. The lender will deposit the stablecoins in order to make them available to the borrower. The latter will have to place other cryptocurrencies as collateral to obtain the loan. Once the lending has been validated, the lender receives interest for the liquidity provided according to the duration of the loan.

You can do some Crypto lending on Just Mining and thus make your stablecoins work, the platform offers lending solutions on USDT, USDC or even DAI.

More solutions to generate passive income through cryptos

There are alternatives to staking or lending to generate passive income through cryptocurrencies, JustMining offers two other alternatives

The Masternodes

An alternative to the PoS validation protocol, masternodes are servers that hold a complete copy of the blockchain in which they participate. They improve network security by adding functionalities during the validation of transactions and also grant voting rights on certain decisions concerning the future of the project.

JustMining offers more than a dozen complete and shared masternodes on their site.

The Mining

Protocol for validating PoW projects, mining or mining is a very common term in the crypto ecosystem. Miners are actually computers that perform more and more complex calculations with each new validated block of blockchain. There are numerous hardware solutions for mining, ranging from simple ASICS miners to mining farms.

The platform offers solutions ranging from the supply of equipment to the monitoring and maintenance of hardware.

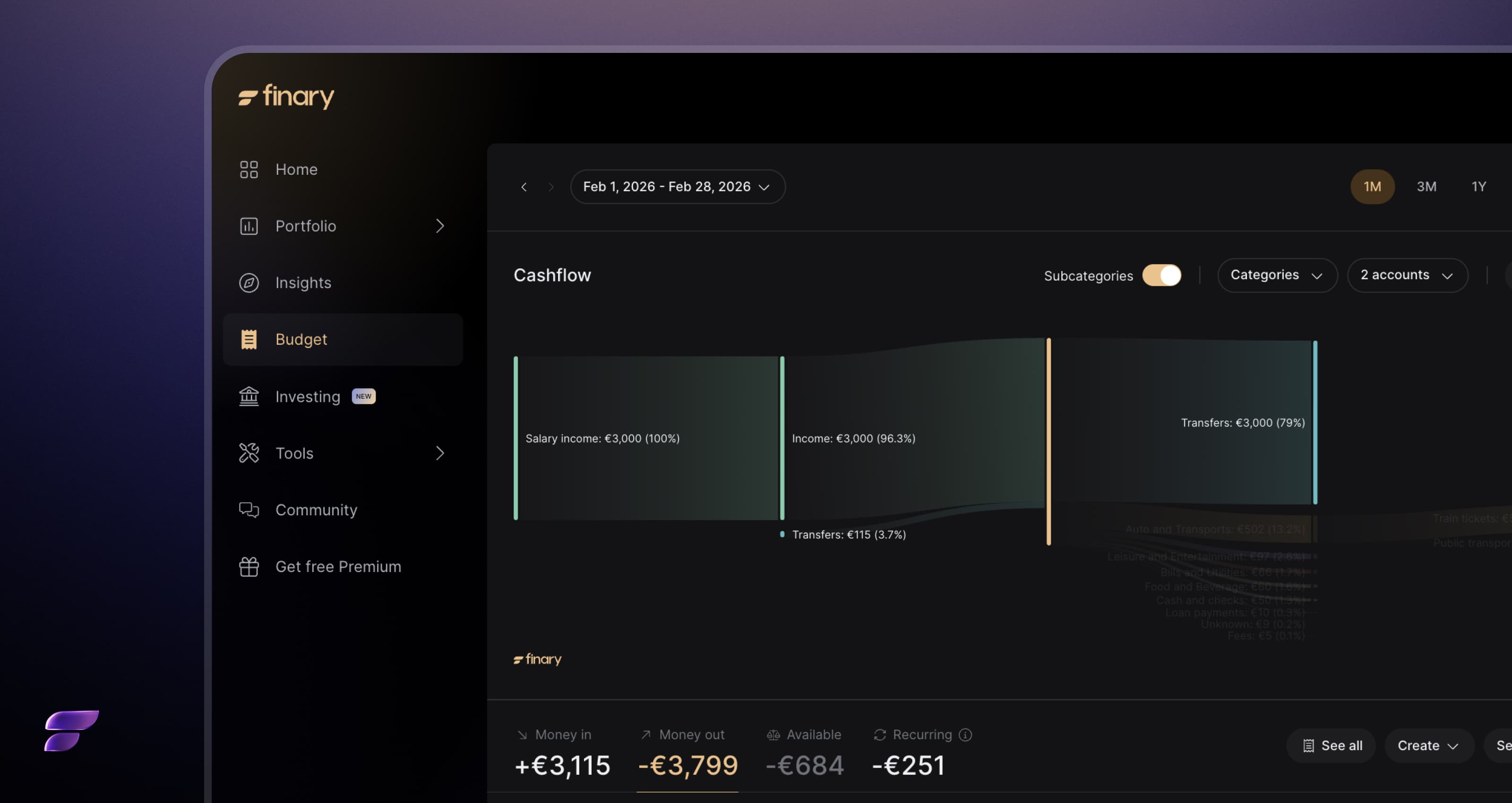

Your Just Mining account integrated directly into Finary

The crypto possibilities are expanding even more on Finary with the arrival of Just Mining, a complete 100% French crypto asset management solution! First French platform offering Staking, Lending, Masternode and Mining solutions to be PSAN approved by the AMF!

Add your Just Mining account to Finary

You can add your Just Mining account in just 4 clicks on Finary thanks to the new integration. The addition is done securely by an API key that you can generate in your Just Mining client area.

View all of your assets staked, in lending, or held directly

By synchronizing it to Finary, your Just Mining account integrates all of your assets, so you can see your Just Mining assets, whether staked, in lending or held directly on the platform.

Exchange with other investors who are passionate about watches on The Finary community and discover new investment opportunities!

More questions about crypto interests

How to generate passive income through cryptocurrencies?

There are several ways to generate passive income with cryptos: you can stake your cryptos in Proof of Stake by immobilizing them in order to contribute to blockchain operations, you can lend your stablecoins via lending, use masternodes to validate transactions and actively participate in the future of a project, or even mine cryptos in Proof of Work with dedicated computers.

How much can crypto earnings bring in?

The crypto return will depend on the method chosen, crypto staking shows up to more than 50% return on investment for some cryptos, lending shows an annual return of around 10% and masternodes can offer interests of more than 25%. For mining, a fixed reward is offered for each block validation, for Bitcoin the reward is 6.25 bitcoins per validated block.

How do I do cryptocurrency staking?

There are many platforms offering crypto staking, for example, you can choose to use Binance Staking, Kraken Staking, Coinbase Staking, Ledger Staking or Just Mining Staking. On these platforms, you will be able to stake your cryptos in PoS, you can in particular stake your Ethereum tokens, your Polkadot tokens or your Solana tokens for example.

How do I do crypto lending?

To be able to do crypto lending, you can choose a platform that will allow you to lend your stablecoins (USDT, USDC or DAI). For example, you can do it on Binance Lending, Kraken Lending, Coinbase lending or Just Mining. You will thus be able to lend your USDC, USDT or DAI to other crypto investors and generate interest.