Mint is Shutting Down: What You Need to Know

Understanding the Shift from Mint to Credit Karma

Intuit, the parent company of both Mint and Credit Karma, announced to shut down on Tuesday 31th of October the personal finance app Mint and integrate its user base into Credit Karma, following the acquisition of the latter in 2020.

Here is the official statement from Mint's team:

We are reimagining Mint as part of Intuit Credit Karma, expanding our collective capabilities to deliver upon our mission of championing financial progress for all. Mint is going away, and we have phased communications and user migration by design so the product team can ensure a smooth transition for Minters who decide to onboard to Credit Karma.

The Transition Explained

This decision was made to streamline and consolidate their services, focusing on providing a comprehensive financial solution through Credit Karma. Mint was known for its budgeting and expense tracking features, while Credit Karma is popular for its credit monitoring and financial recommendations.

What Mint Users Can Expect

The shift appears to have been gradually introduced, as evidenced by discussions among Mint users on Reddit, where they've shared their experiences with notifications urging them to transition to Credit Karma over the recent weeks. Discussions on the topic, various user reactions, and warnings about the migration have been cropping up, indicating a move that's been in motion behind the scenes.

Here are main complaints seen from users from Mint’s subreddit:

- Irreversible Migration Process: Users are expressing deep dissatisfaction with the migration process from Mint to Credit Karma. One user's experience highlights the issue: "I just made the mistake of doing the 'link'. It's not a link. It's a full-stop hard migration." This indicates that the transition is not a simple, reversible account linking but a permanent move that users did not anticipate, leading to a sense of being misled.

- Loss of Mint's Distinct Features: The community is particularly aggrieved by the disappearance of specific features that were integral to Mint's appeal. As one user laments, "Budgets? All the different views on spending? All gone as of now." This showcases the users' attachment to Mint's budgeting tools and customized spending views, which are now inaccessible post-migration.

- Frustration with the Lack of Control: There is a palpable sense of frustration over the lack of control or choice in the migration process. A user articulates this sentiment: "I'm at a loss. I'm pretty upset at how this went and now I can't go back after the 'link'." The inability to revert to the familiar interface and functionality of Mint has left users feeling powerless and upset.

As the transition occurs, Mint users should be prepared for a shift in user experience and platform functionality. They will be directed to switch to Credit Karma, where they can expect similar but potentially enhanced features and tools for managing their personal finances. The shift will likely involve migrating existing data and customizations from Mint, easing the transition to the Credit Karma platform.

Some key benefits and features that users may expect to find in Credit Karma include:

- Credit monitoring: With Credit Karma, users can keep track of their credit scores and receive updates on changes in their credit reports.

- Personalised recommendations: Based on users' financial profiles, Credit Karma can offer suggestions for credit cards, loans, and other financial products that may be beneficial.

- Financial tools: Credit Karma provides a suite of tools for managing various aspects of personal finance, such as savings, debt management, and budgeting. These tools are designed to help users make informed decisions about their financial goals.

Overall, the switch from Mint to Credit Karma represents a broadening of Intuit's focus on delivering an encompassing financial management platform. Mint users should expect some changes in the user experience and offered services but can look forward to a more comprehensive set of tools and features with Credit Karma.

The Business Realities Behind the Closure

Despite its popularity and influence in the personal finance world, Mint's closure stems from various business reasons. One factor to consider is the business model of providing free services to users while generating revenue through advertising and referral offers. This model may have led to misaligned incentives, as the app's primary focus might have shifted from user experience to revenue generation.

Intuit's acquisition of Credit Karma, a similar personal finance platform, played a significant role in the decision to close Mint. As both products offered budgeting and financial tracking tools, it appears that Intuit chose to consolidate its resources and direct users towards Credit Karma, potentially to create a more unified and streamlined user experience.

In closing Mint and transitioning users to Credit Karma, Intuit is navigating the business realities of maintaining and growing a successful personal finance platform. As the landscape of financial tools and products continues to evolve, companies like Intuit must make strategic decisions to remain competitive and relevant in the industry.

Alternatives for Mint Users

Subscription-Based Personal Finance Apps

For Mint users who are looking for an alternative to manage their finances, there are several subscription-based personal finance apps available.

Some popular choices include Finary, Simplifi, You Need A Budget (YNAB), and Tiller. These apps typically offer a more comprehensive set of features and are designed to help users achieve long-term financial goals.

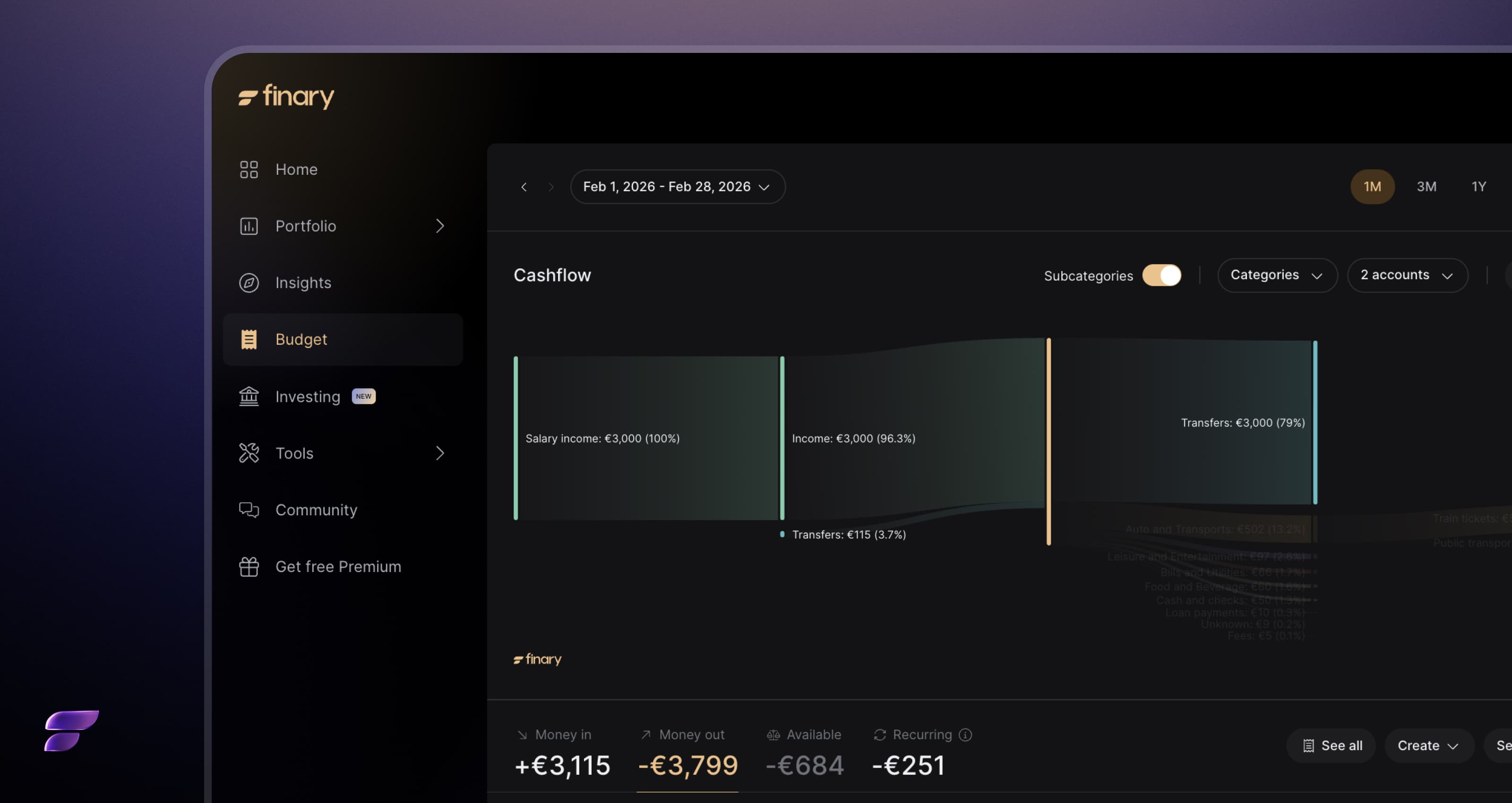

Finary is a wealth management platform that offers helpful tools such as expense tracking and investment management, and is really near releasing the budgeting feature that Mint was known for.

Simplifi by Quicken is a budgeting and personal finance app that offers automatic expense tracking, customizable budget categories, and personalised saving insights. It has a monthly subscription fee.

YNAB is a budgeting tool that focuses on helping users give every dollar a job, track expenses, and plan for future financial needs. YNAB comes with a 34-day free trial and charges an annual subscription fee.

Tiller provides users with a customizable spreadsheet interface for financial tracking, budgeting, and reporting. It can automatically import transactions and balances from multiple accounts and is available for a yearly subscription.

How to Prepare for the Transition

Data Migration and Security

As Mint prepares to shut down on January 1, 2024, it is crucial for users to ensure the secure migration of their data to a new personal finance platform.

Here are two videos explaining how to download your financial data before it's gone

Before making the switch, review the privacy policies and data protection measures implemented by the platform you are considering. Look for a platform that utilizes strong encryption protocols to safeguard your data.

When transferring your data, be sure to verify that all financial accounts and transactions are accurately migrated. Some platforms may offer automated migration tools or assistance from their support team. It is also a good idea to keep a backup of your Mint data, in case you need to refer to it later.

Evaluating New Personal Finance Platforms

When looking for a new personal finance app, consider your needs and preferences in terms of user experience, features, and compatibility with multiple accounts or data aggregators.

Take the time to research and compare competitor platforms on the basis of the following criteria:

- User experience: It's essential to choose a platform with a user-friendly interface and easy navigation, ensuring a seamless transition from Mint.

- Multiple account support: If you have accounts with various financial institutions, select a platform that supports connections to numerous banks and credit unions.

- Data aggregators: Some personal finance apps use data aggregators to gather your financial information from different sources. Verify that the app you choose has a reliable aggregator to ensure consistent and accurate updates.

- Features and tools: Depending on your financial needs, you might require budgeting, goal-setting, or investment tracking features. Assess the range of tools

- Subscription-based business-model: offers significant advantages by ensuring that the company's goals are closely aligned with the user's needs. As paying customers, users have a direct influence on the service development, leading to a superior user experience. This model also facilitates ongoing investment in data quality and connectivity, which is crucial for services like personal finance apps where up-to-date and accurate data is essential. Moreover, it prioritizes user privacy, as there's no need to monetize user data through advertising.

By carefully evaluating these factors, you can make an informed decision when selecting a new personal finance platform to replace Mint. Based on these criteria, Finary is one of the best alternatives to Mint. The good news is you can try the platform for free and save big on your hidden fees.

Frequently Asked Questions

Is it possible to transition from Mint to Credit Karma?

Yes, it is possible to transition from Mint to Credit Karma. Intuit, Mint's parent company, is encouraging users to shift to Credit Karma, a similar personal finance app that the company acquired in 2020. Users can sign up for Credit Karma, input their financial information, and link their accounts to start managing their finances on the new platform.

Here is the guide from their help center on how to transition from Mint to Credit Karma.

What are the top budgeting apps to consider?

Some of the top budgeting apps include:

- Finary: Streamlines budgeting and investment tracking with a focus on portfolio oversight and financial planning. It offers insights into spending, savings, and investment diversification, helping users optimize their financial strategy in real-time.

- Credit Karma: Offers a variety of tools to manage finances, including credit monitoring, budget tracking, and tax services.

- YNAB (You Need a Budget): Focuses on a proactive budgeting approach, emphasizing saving, reducing debt, and managing funds effectively.

- Personal Capital: Provides a comprehensive view of personal finances, including tracking investments, budgeting, and retirement planning.

- Quicken: Offers various budgeting and expense-tracking tools, with both desktop and mobile app versions available.

- Clarity Money: Assists users in managing expenses, finding savings opportunities, and tracking financial goals.

These apps cater to different user needs and preferences, so it is important to explore each app and choose the best fit for individual requirements.

How can I connect my Credit Karma account with Mint?

Since Mint is shutting down on January 1, 2024, Intuit will no longer support linking or syncing Mint with Credit Karma. Users are encouraged to transition completely to Credit Karma for their personal finance management needs. To do this, sign up for a Credit Karma account, input all relevant financial information, and link financial accounts to start tracking expenses and budgeting on the new platform.