December 2025 Product Update

Portfolio tracking is at the heart of Finary. It’s what allows you to follow your investments, understand how they evolve, and make better long-term decisions.

To deliver on this promise, one thing is essential: data reliability. This is my priority for the coming months.

🎯 A clear priority: wealth tracking reliability

Our teams are continuously working on fixes and incremental improvements, with a clear goal: to strengthen the reliability, clarity, and value of wealth tracking.

This includes:

- constant work on synchronizations to make them more robust and readable, and to clearly explain what's happening when action is required,

- strengthening data foundations and calculations to ensure a consistent and reliable view of your wealth, cash flows, and analyses,

- regularly adding readability and usability improvements to facilitate navigation, understanding, and analysis of your data, and better meet everyone's expectations.

↗️ 29+ fixes and improvements already deployed

In recent weeks, several improvements have been deployed and are now visible in the product. We first worked actively on restoring several synchronizations.

Linxea and Interactive Brokers (IBKR) are now operational again, with a gradual rollout to ensure stability.

Corum Life is currently being deployed and should be restored in the coming days.

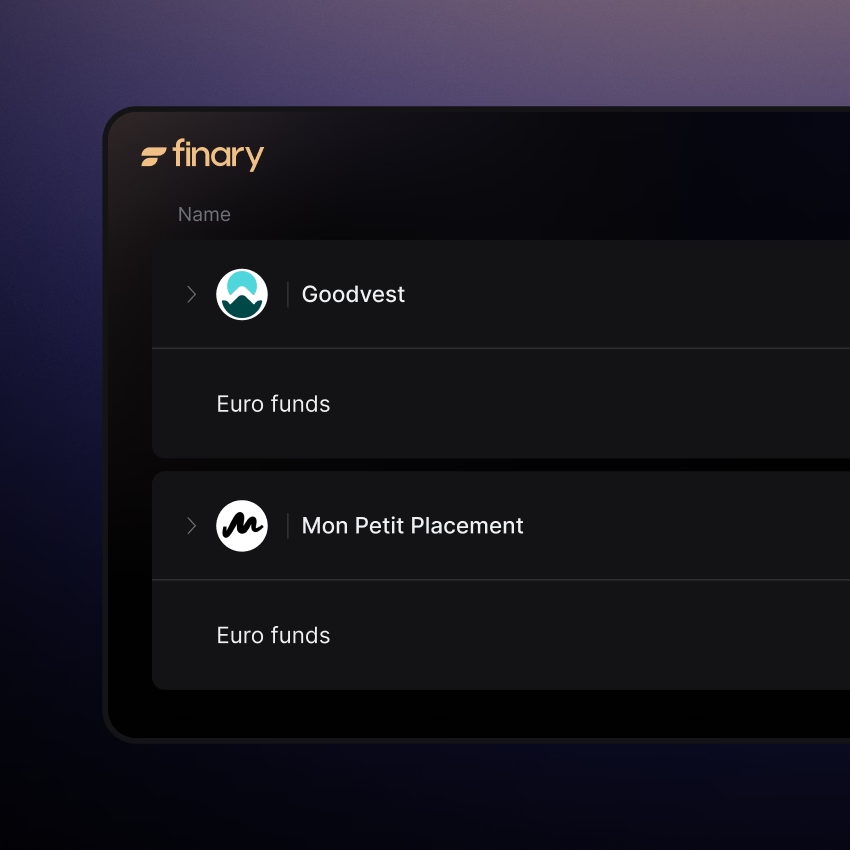

On the fixes side, we've integrated euro funds from Mon Petit Placement and Goodvest, which weren't being reported correctly until now.

We've also fixed a bug that prevented adding mortgage loans to an asset.

Our priorities for the coming weeks focus on Crédit Mutuel (savings), Trade Republic (PEA), and Yomoni. Other integrations are also being fixed as I write these lines.

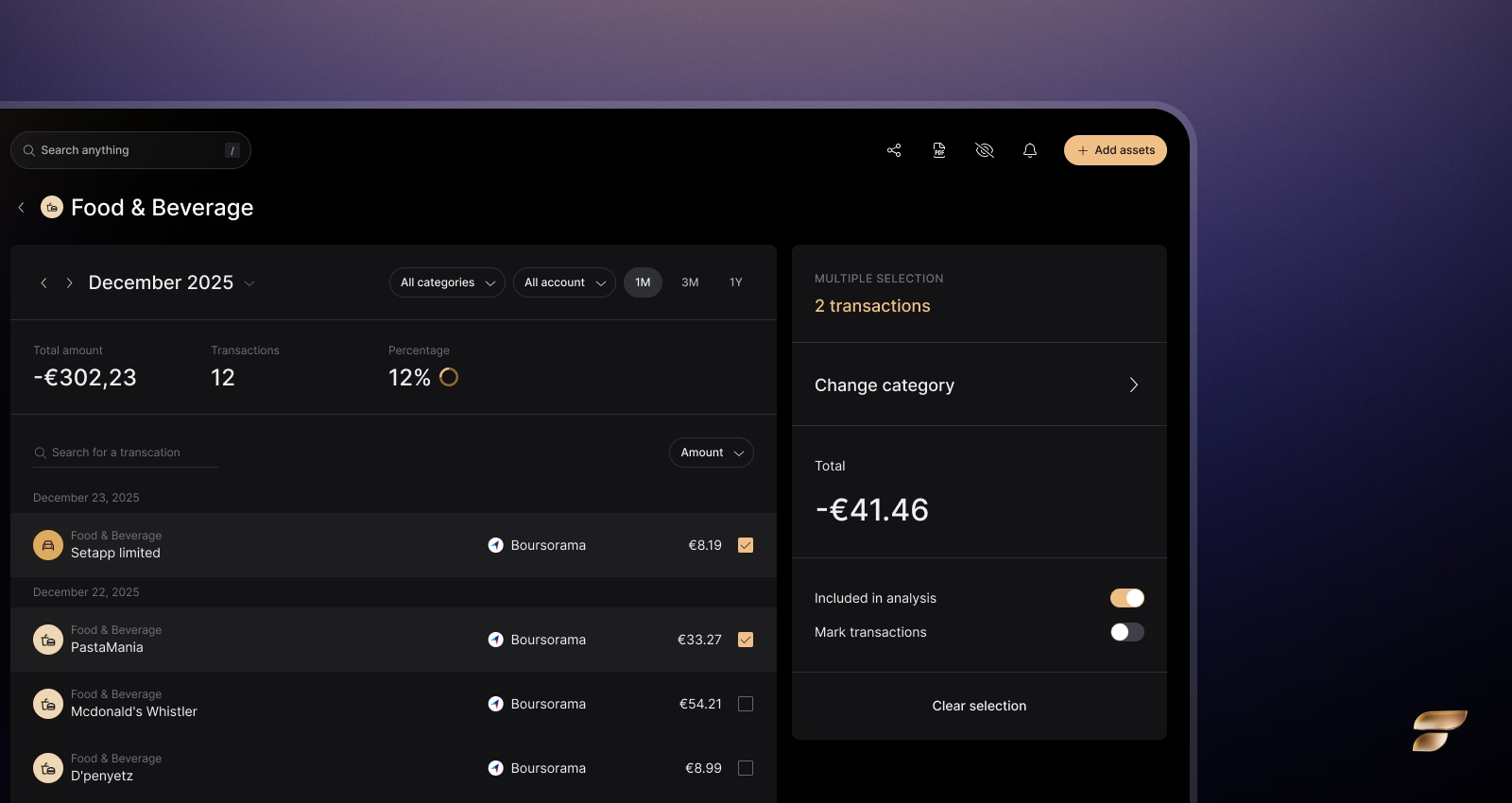

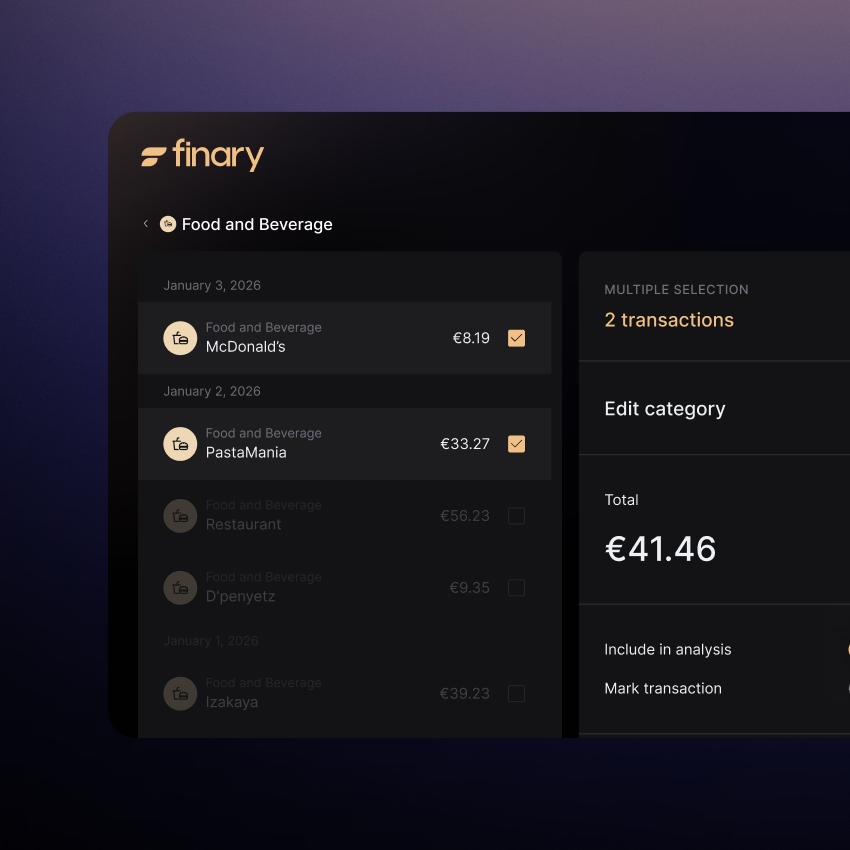

Budgeting has been completely redesigned to be smoother, faster, and more consistent between Web and App. We've drastically simplified the most common actions and fixed several major friction points.

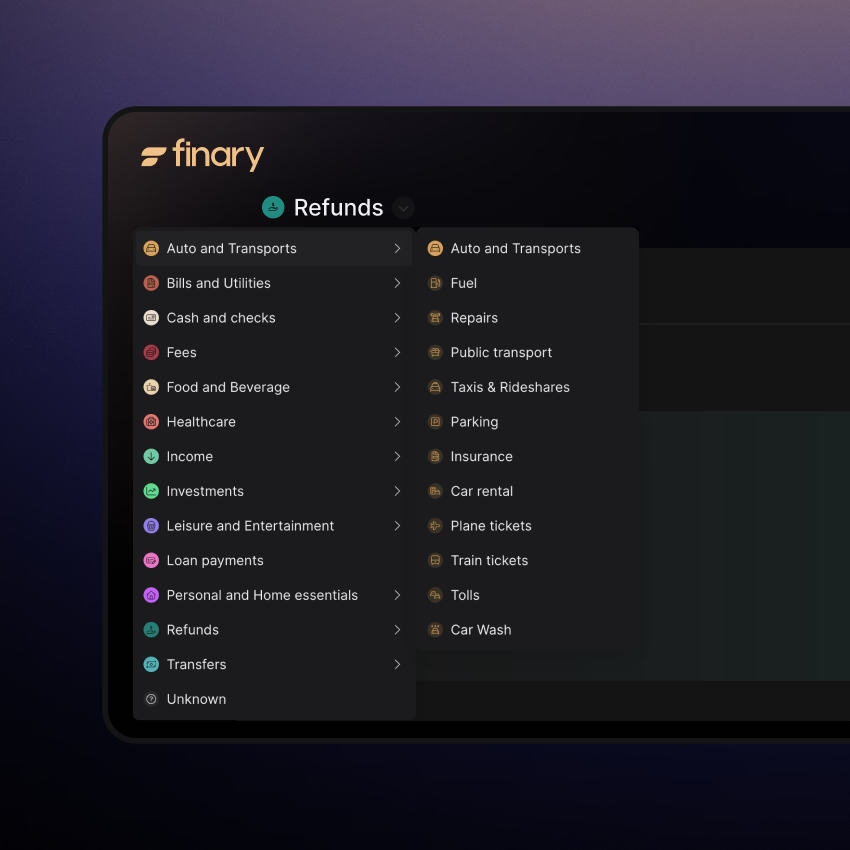

A click on the category icon makes it super fast to change it.

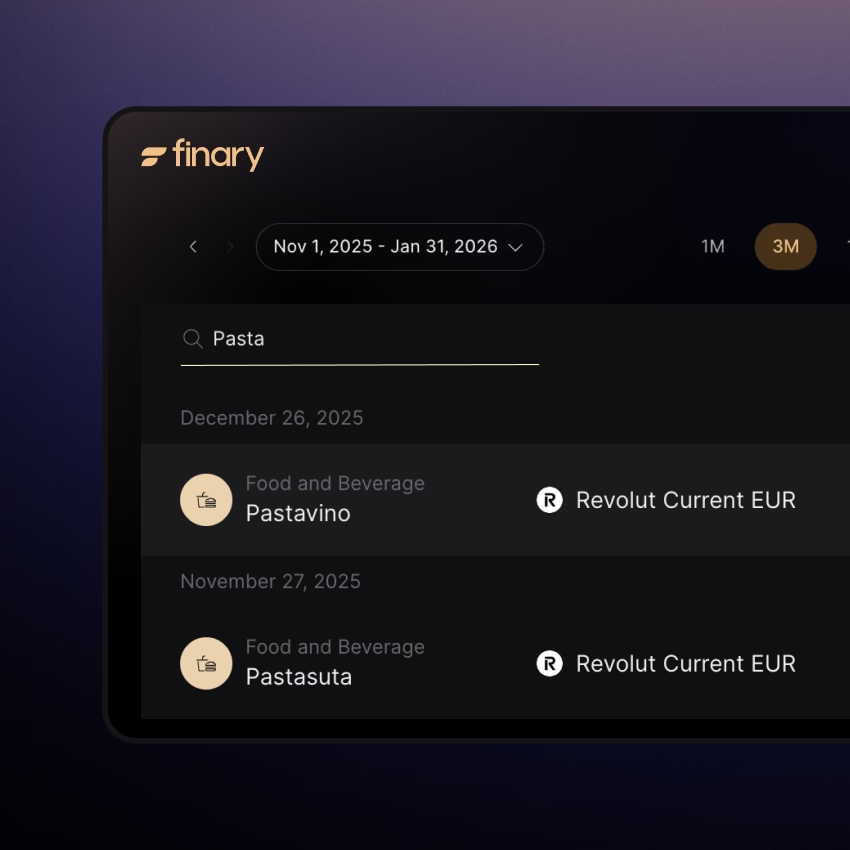

Our new integrated search helps you find the right category in just a few letters, and a multiple selection checkbox lets you process several transactions at once.

You can now filter directly by subcategory and quickly navigate between categories.

Your filters are finally preserved across views, tabs, and even after a page refresh.

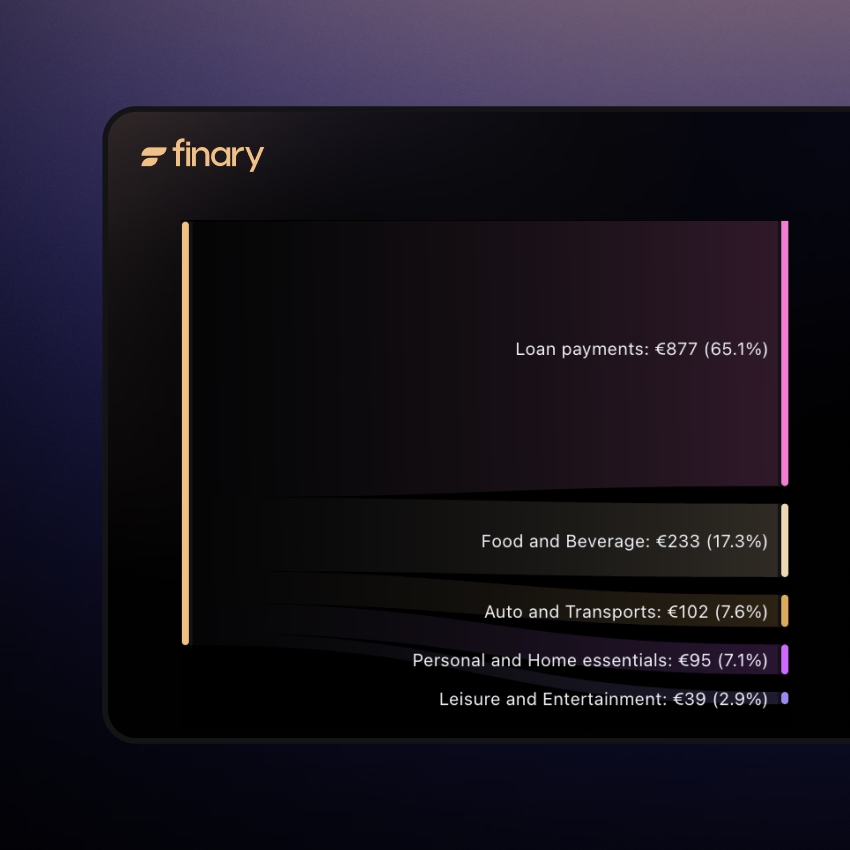

Distribution percentages are displayed directly on the flow diagram.

The Subscription Scanner is accessible from the Analysis section on Web, with a dedicated card in your Insights.

Transaction search now works with the displayed transaction name. Distribution percentages are displayed directly on our beloved flow diagram.

You often hear from me, but I have a whole team working tirelessly. Nine talented team members are currently dedicated to these fixes and improvements, and we are actively hiring more.

All deployed improvements, ongoing fixes, and upcoming priorities are shared on the Finary Community.

👉Track the team's progress here (in french)

👷 What we're building next

In parallel, we're working on a structural evolution of wealth tracking: building an agnostic system that allows creating manual transactions even when synchronization is finicky.

Specifically, this foundation will enable:

- a view of your wealth by asset class,

- a reliable history of your wealth and investments,

- a clear distinction between your contributions and performance,

- more flexibility to correct and adjust your data when certain synchronizations are imperfect.

This is also the necessary foundation to enrich Finary tomorrow with features around tax management and AI agents.

Meanwhile, other teams are working on our investment products: Finary Life's self-directed management (and related actions), our future brokerage account, and our highly anticipated PEA. More details to come in a future edition.

Join the adventure!

The Finary team keeps growing! We are currently hiring for 15+ positions, including:

Feel free to apply or forward the job descriptions to your friends!

Thank you for reading this newsletter. I regularly share my analyses to help you better manage your wealth and Finary news on Instagram, X and LinkedIn, follow me !

Finary SAS, a member of the National Chamber of Wealth Management Advisors, has a share capital of €1,625,000 and is registered with the Paris Trade and Companies Register under number 892 357 724. Its headquarters are located at 58 rue de Monceau, 75380 Paris 8. Finary SAS operates as a Financial Investment Advisor (CIF) and Insurance Broker, registered with Orias under number 21001279, and is a member of the National Chamber of Wealth Management Advisors, an association accredited by the French Financial Markets Authority (AMF), with financial guarantees provided by Assurances Mutuelles MMA IARD.

Investing may carry risks, particularly of capital loss (more or less significant depending on the nature of the investment) and no guarantee of performance, but may offer the prospect of higher returns in return for these risks.

*This advertisement does not constitute an offer or personalized advice. It has no contractual value. For complete and personalized information, please refer to the regulatory documentation of the contract, including the general terms and the information notice.